How I Started My Online Course Business

Platform Review

Platform Review

Learn my personal story about how I created my online course business from scratch (with all the practical details like payments, taxes, company creation and more).

At this point in your online course creation journey, you have already chosen a course topic, you have recorded your first course, and you have set up your own online course website.

So that's the fun part. But now, you have to know how to make it all legal, meaning you need to know how to sell your courses properly, invoice your customers when requested, and report your taxes, just like any other business.

So let's talk about it, I'm going to tell you in this post how I set up my own online course company from scratch, and talk about all the steps involved: including how to take payments, accounting, taxes, and all that fun stuff 😉.

The goal of this guide is to share with you all the practical information that I can think of on how to start an online course business with minimum hassle.

Many of these are of course dependent on the country where you live, but a lot of the steps will probably be similar for you.

Please bear in mind while reading this guide, that I'm just sharing here my experience as an online course entrepreneur, and that I am not an accountant or tax professional.

Although I think the information in this guide will help you a lot, this does not replace contacting an accountant in your country to learn how to do it properly, by the book, OK 😊?

I think learning how I did it will for sure give you a good starting point to begin to understand how all these things work, but make sure to contact the correct professional when starting your business, typically an accountant.

So now that we got that out of the way, let me tell you how I set up my business from A to Z, I'll go through the whole story.

If you are looking to learn more about online teaching in general, you can find all of my guides on the Academy home page, in the recommended reading order.

The previous article in this series is: How to promote your online course - complete guide.

So without further ado, let's get started learning everything about how I created my own online course business from scratch, step by step!

When did I create my online course company?

I think that in most cases, there is no need to create an online course company upfront, before even recording a single course or making a single sale - I certainly didn't do it myself.

In fact, I think you can start your online course journey months or even years before creating a company!

And this is because the process of growing an audience for your courses, identifying course topics, and creating online courses can take a while, and during the production of my first course, I actually had minimal expenses and there wasn't any revenue coming in initially, so there was nothing for me to be taxed on.

Creating a company did mean some expenses, like paying an accountant to set it up for me, or providing some initial capital.

Given all this, you might not want to trigger this process immediately at the beginning of your own online course journey.

You might choose to develop a blog or YouTube channel to create traffic around your course topic, before deciding to create premium courses and start a business.

I recommend at least trying to grow an audience first before you start to create online courses, and for this, you won't need an official company, at least not straight away.

However, when I was close to finishing the recordings of my first course, and I was planning on making my first sales, then that was a good time to start thinking of creating a company.

In my case, I had a small freelancing company that I had already created a few years before, in order to bill my customers for my freelance per-hour work as a software developer.

So I had just reused the company, as the accountant that created it for me had the foresight to make it a really generic IT company, that could also be used for selling training material on the topic.

In your case, you can inform yourself upfront as much as possible, and identify a reliable accountant. This gives you the flexibility to trigger the company creation process as close to the initial sales as possible, and avoid having too many upfront costs.

How to create an online course business?

So what type of company did I choose? This is going to be country-specific, but in general, I preferred to go for some sort of LLC or Limited Liability Corporation.

There is an equivalent to this type of company probably in just about every country, and it's usually relatively simple to set up.

I think this is the ideal type of company for small business owners. This type of company has been historically created a long time ago to protect the families of small business owners from being personally affected by the bankruptcy of their family business, so that sounded good to me and I went for it 👍.

The advantages of online course companies

I didn't worry a lot about my online course business going bankrupt, because like most types of online businesses that sell digital products, the expenses of my company are very low and the margins are very high.

In my online course company, sales are almost all 100% profit, compared to companies that have to employ large numbers of employees and have fixed expenses, like shipping costs, rent, or materials.

With my online course company, I work from home at least to start with (I'm moving to an office soon), it's just so convenient and affordable.

Other than some initial equipment investments I had to make like a microphone or a few lamps, I only have limited recurring costs, such as for example my subscription for my email marketing software.

To create online courses, I typically don't need full-time employees. I just need the occasional freelancer help for example for artwork.

Remember, online courses are fully digital products. There are no shipping costs involved, the production cost is very low (the main resource is my time), and they only cost a limited amount to host on a server.

It's no secret that this type of online-only business that only sells digital products is a very lucrative and viable type of business, compared to most traditional businesses.

Why did I choose an LLC or Limited Liability Corporation?

I chose this type of company because it tends to be ideal for small business owners, as my company assets are completely separated from a fiscal point from my personal assets.

Let's say that for example my company for some reason gets into trouble and needs to close (which is unlikely for an online course company).

With an LLC, unless in the case of proven reckless management, any debts of my company are not going to have to be paid by having to sell for example my house or my car.

My personal assets are not part of the company, and cannot be used to pay company debts, so my personal wealth is protected legally from potential hard times that my company could fall into, which is exactly the assurance that I need as an entrepreneur.

Notice that this is of course just my opinion as a business owner. You will need the help of an accountant to create your company and choose the company type, unless you can create it fully online and in a simplified way in your country.

But this should get you started thinking about what type of company you need. I personally really like the idea of the level of protection that an LLC gives me, and so I went for it.

But in your country you might have even better options, so make sure to explore that with your accountant.

Where did I create my online course company?

You might have heard of all sorts of clever tricks about where to register your online company, to enjoy a reduced tax rate.

Be careful with that, I don't want to scare you but the truth is that the difference between fiscal optimization and fiscal fraud is jail!

As a small entrepreneur myself, I'm just not in the position at least initially to be able to afford the financial advice that I would need to pull that off correctly, and even then I personally would never consider it.

What I did is I just opened a regular company in the country or state where I live (Belgium), literally as if I was opening a bakery or a hairdresser, and I just followed the advice of my local accountant.

How did I create my online course company?

I recommend making an appointment with your accountant. After they understand what your business will be about, they will typically write a draft for the company statutes, and send it to you for review, that is how the process went in my case.

The company statutes is a legal document that describes what my company is about, what are the company goals, what will the company be doing, etc.

I was lucky that my accountant wrote the statutes in more generic terms instead of more specific ones. This might help me in the future if I decide to take the company in a slightly different direction, like, for example complementing online courses with in-person classes.

To give you an example, I think that creating a generic professional training company is better if possible, as opposed to a company that only sells online courses.

Once you review and discuss the statutes of the company, your accountant will typically schedule a meeting with a notary in order to create the company, or he might even be able to do everything online for you.

At least that is how my company was created, I went to a notary with my accountant, signed the papers, paid them all 😉 and voila!

If you did this yourself, congratulations, your online course company is now created.

How much did it cost to create my company?

This is of course completely dependent on the country, state, and type of company. Depending on that, this could cost a completely symbolic amount like $1, to zero or more typically a few hundred or even thousands of dollars.

Besides paying for the act of creation to my accountant and notary, I also had to provide some sort of initial capital.

This is because my company had some initial expenses, like the accountant for example. And because my personal capital is fully separate from the company, this means that the company would have no money to spend!

So you will also usually have to provide some initial amount to fund the company. For example, I was asked to provide around $10k in a company bank account, and that was the initial capital of my company.

I used that initial capital to buy equipment and services that I needed, so it's not like the money was lost or anything.

What I wasn't allowed to do, was transfer it back to my personal account, as this would be considered salary.

How to pay myself a salary as an online course creator?

Speaking of salary, how do I pay myself, once the company started making sales?

It's important for you to realize that if you do this, you are no longer an employee. You are now the manager of a company, which in the case of the country where I live is a separate fiscal status with its own set of rules.

I am able to set a salary for myself, and I can transfer it monthly to my personal account and pay personal taxes on it. Be careful, because the more you transfer, the more taxes you are going to pay, and this might catch you by surprise.

Check the tax brackets in your country, for example here after a certain amount I'm paying 50% taxes to the state for every extra dollar that I transfer myself as salary 😱.

Again, I recommend checking with your accountant for how to set up a monthly salary and get a regular monthly salary sheet.

I know that this all sounds very dry, but the good news is that this is only going to need to be done once, and it's much easier than you think.

All you have to do is a bit of homework before meeting your accountant, and everything is going to go smoothly.

Again, because this is a bit of a cumbersome process (although simple), you might want to delay it too much closer to the moment when you make your first sales, to avoid any upfront expenses.

Growing an audience is a slow process that can't be rushed, and there is no need to create a company while your audience is still small.

Speaking of sales, how was I able to accept online payments?

How do I accept online payments?

For example with the OnlineCourseHost.com platform, you are going to be accepting all your online payments either with the Stripe platform or with Paypal.

Unlike the creation of your company which can be delayed, I think it's important for you to create your Stripe and Paypal accounts ASAP as soon as you start planning on selling online courses.

Check here the list of supported countries. Stripe is available almost anywhere, and notice that if your country is marked as "Preview" on the list, this means that Stripe works there just fine but their engineers are monitoring the payments really closely, as support for that country was just recently launched.

The same goes for Paypal, here is the list of supported countries.

There are no recurring costs of any kind for creating a Stripe or Paypal account, it's completely free. There is no free lunch of course, so if you are wondering, the way that they make money is by charging a small percentage fee on every payment that you collect 😉.

But their rates are quite affordable, but still, it's something to bear in mind. You will get a monthly report detailing how much you are paying as fees, and you will have those fees deducted as business expenses.

Unlike creating your company too early, there is absolutely no downside to registering on Stripe or Paypal (or both) early, so go ahead and do that as soon as possible.

All you will have to do is provide your name, email, personal bank account number, and a picture of your ID.

Once you provide these details, you will get your account automatically approved, this will typically take only a day or so, maybe even less.

Please don't worry, as Stripe or Paypal are not going to make it hard for you to open an account at all, you will only need to provide minimal details that are legally required.

Later, when you create your company, you just have to add your company details, bank account, and tax identifier via the Stripe or Paypal dashboard.

How to track the performance of your online course business

The Stripe dashboard has an awesome user experience, and it allows me to manage my whole online business very easily, and that is one of the reasons why I recommend using it.

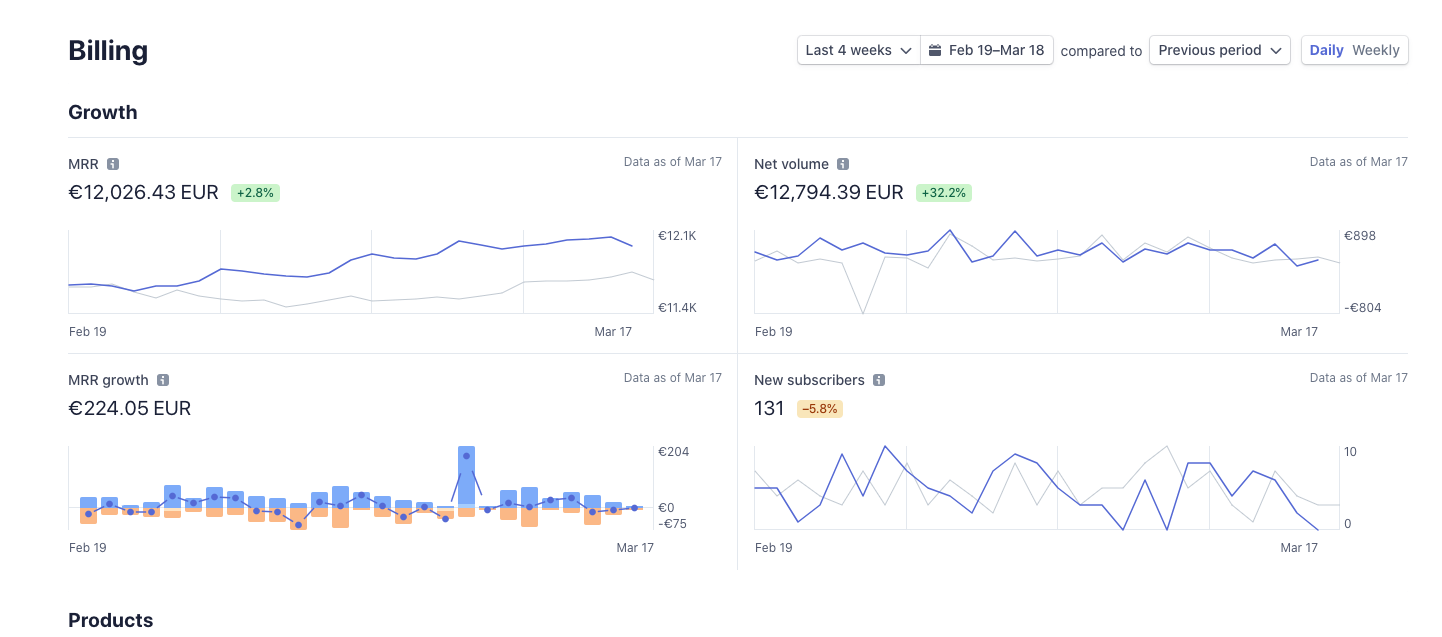

Here is what my dashboard looks like, once I started collecting some payments:

You have your billing dashboard available here if you have created your Stripe account already.

The most important number to keep in mind to monitor the health of your business is the MRR or Monthly Recurring Revenue, in case you are using a subscription model.

MRR measures the expected recurring revenue, based on your current amount of subscribers and the plans that they are subscribed to. It's very accurate in predicting your upcoming monthly revenue.

As I have covered in my marketing strategy guide, I recommend a mixed model where you offer the courses separately and provide a subscription as an alternative.

Most people will take the subscription, but you will be surprised at how many courses you will be able to sell separately as well.

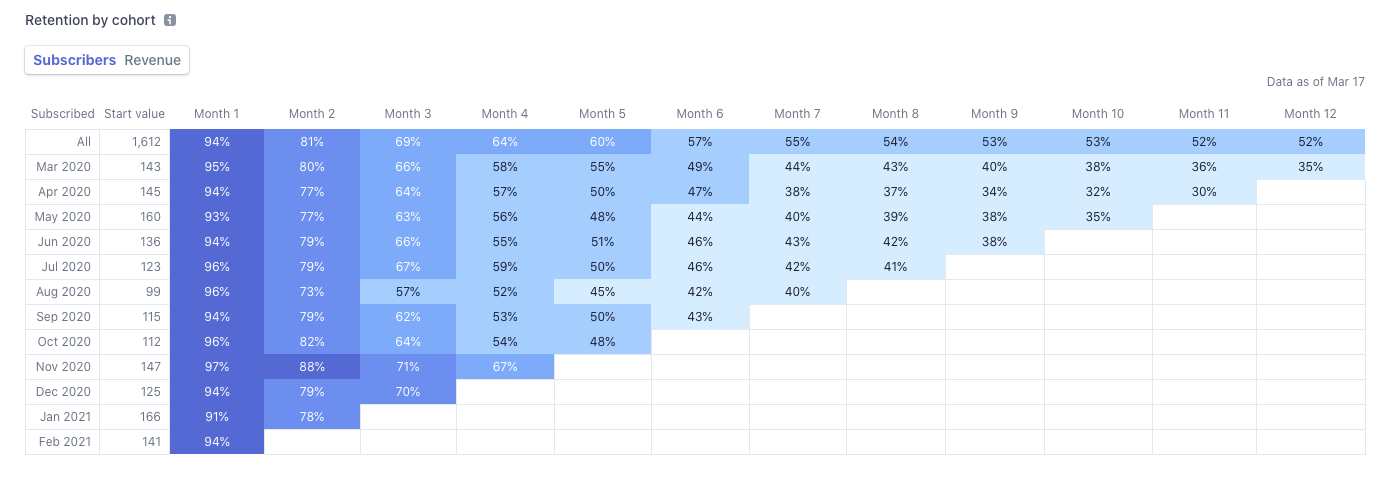

Another important chart that you get from the dashboard is the subscriber retention chart, which gives you an idea of how well you are retaining your premium members:

With this, I can also see all my received payments history and have an idea of the revenue generated on the last day, week, month, year, and all time.

As you can see, the Stripe dashboard is an invaluable tool for monitoring the health of my online course business!

But another very important feature that Stripe provides, is the ability to automatically generate email receipts.

How do I create email receipts?

Once a customer makes a payment, you will automatically see that same payment listed in your Stripe dashboard.

The customer will also automatically receive an email receipt from Stripe, which as far as I know is sufficient for the vast majority of consumer B2C (business-to-consumer) sales.

Think about this type of sale like when you go to the supermarket to buy food: that is a typical B2C sale that does not record an extended invoice.

The ticket that you get at the cash register is just a receipt, and nothing more. But if you are for example a restaurant owner and you need an invoice, you can ask it and they will issue it, but as you can imagine most of the customers of the supermarket don't need a full invoice.

The same goes for a typical online course business: most of your sales will be B2C and only a few customers will need a full invoice, while most others just need a receipt, and that is what is automatically generated by Stripe.

I can fully customize the template of the receipt and brand it according to my company theme.

As you might know, a receipt is just proof of payment of a given amount, and there is usually no tax information on it, or detailed customer identification information.

For that, we need an invoice, but because Stripe does not calculate taxes, its invoicing capabilities are limited at the moment.

This brings us to our next step, and you can't escape it: you need to learn how to pay taxes on your revenues ☺️ 😱!

How do calculate and pay my course sales taxes?

If you got to the point where you need to know how to pay taxes on your online course revenues, it means that you have successfully created a company, so congratulations!

I'm going to cover the two types of taxes that I have to pay myself in this guide, these are company taxes and VAT. Let's start with VAT or Value Added Tax.

So how do VAT taxes on the Internet even work? If you are selling digital products to foreign countries, do you have to register for tax purposes in those countries?

If you are looking to learn about online payments taxation, I really recommend checking this article Digital Tax Around The World, because as you know I'm not a tax expert myself.

But in the remainder of this guide, I'm going to give you a high-level picture of what you likely can expect, based on my own experience.

Concerning taxes, every country has its own rules, and it's impossible to keep track of everything by myself. And Stripe won't help me with taxes either, at least not for now.

I believe that in the future, taxes are going to be collected and paid to countries directly by online payment platforms like Stripe, and I won't have to worry about it at all.

It's just going to be subtracted all from my pocket right at the source, awesome ☺️!

But for right now, welcome to the wild west of online payments taxation! Many countries around the world have their rules for online payment taxes, including for example the European Union where I live in.

How do online VAT sales taxes even work?

You might think that because you live in one country, and your students live in another country, you don't have to pay any VAT to the country where your customer lives.

Well, many of those countries don't agree with that ☺️, and this includes the European Union, the US, etc.

From what I understood, the general rule is that it doesn't matter where your company resides physically.

If I sell something to someone living in a given country, that country's government is going to want to collect VAT on that sale independently of the location of my company or my internet servers.

The only thing that matters is that I sold something to someone that lives in that country. Imagine that I opened a filial of my company in that country, and performed a sale that way, I would have to pay VAT to that country, right?

The same goes for if I make a digital sale to someone living in that country, the government still wants their cut ☺️.

Otherwise, everyone would open e-commerce stores and start selling their products online and get a reduced tax rate, which would be an unfair advantage to traditional companies.

In general, taxation rules are being developed across the world that submits online sales to more or less the same rules as traditional sales, to create an even playing field.

Countries wouldn't want their nationally established companies to be at a commercial disadvantage when compared to foreign companies, so that is why these digital product taxation rules are put in place in the first place.

So that is the gist of it that I could piece together, but again you want to refer to the Quaderno blog if you want the nitty-gritty details and subscribe to their newsletter to keep up to date.

The good news is that these taxation rules usually have minimal thresholds!

So only if I exceeded certain threshold amounts of tax due am I required to register with a given country for VAT purposes.

For my typical 6-figure online course business, this means that in most cases these thresholds aren't reached, which is awesome!

However, each country is going to have different rules, so the only way that you have to make sure that I'm paying my taxes correctly is to get a tax calculation software.

What tax calculation software do I use?

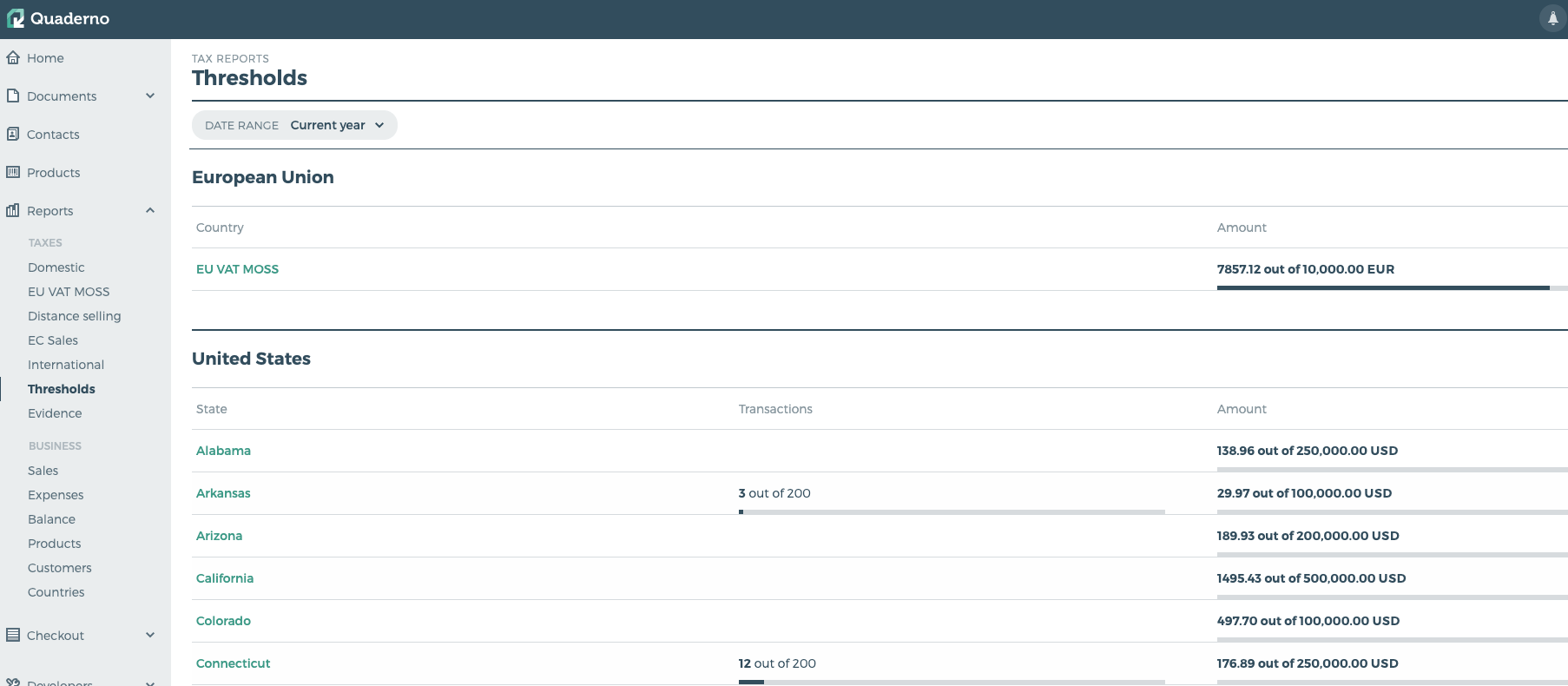

There are many different brands of software available for doing online sales tax calculations. I personally use and highly recommend Quaderno:

As usual, I don't have any commercial affiliation with Quaderno, other than the fact that I'm their customer.

I have been using Quaderno to solve all my online taxation problems with great success for several years, and can testify that it just works and gets the job done.

Besides the product itself being great, I think that the Quaderno blog is one of the best resources available online for understanding the taxation of online payments, if not the best.

Nowhere on the internet did I find the information that I needed about digital taxes laid out in a way that is easily understandable by the average online entrepreneur.

After reading the posts from their blog that apply to you, you will be in a much better position to ask for further advice from your accountant or understand his explanations in general.

It might sound boring, but remember: you will only have to do it once, and then you are all set! It should not take you more than a well-spent morning ☺️.

How do I calculate my VAT taxes?

After activating my Stripe account, I could then create my Quaderno account, and turn on the Quaderno integration.

Quaderno then imported my transactions, and calculated my owed tax per country, according to the known legal thresholds.

I think Quaderno will only calculate the taxes for transactions from the moment you activate it. But I contacted their helpdesk and they scheduled a batch to calculate all my transactions from the beginning which was awesome on their part.

The result was a nice report that I can use to know what thresholds exist, and the list of countries to which I owe taxes:

As you can see based on this thresholds report, I only have to register in the European Union for VAT purposes if I sell more than 10k EUR worth of online courses in a single year.

It's not too hard to exceed this threshold in a given year, so you will probably have to register for VAT purposes there as well.

You can also see that for most states in the US, you only need to register for VAT if you sell several hundred thousands of USD to that particular state.

If these thresholds are relevant to you, it means that your company is probably making millions in sales worldwide!

This won't be the case for the typical online course business run by usually one person, so most of does not apply to us, especially at the beginning.

If you think that you are not eligible for these foreign VAT taxes early on as your company is only ramping up its sales, then you can always wait until later before activating your Quaderno free trial.

Using the trial, you can then make an assessment to see if you are going to determine if you need to use the Quaderno tax calculation service or not, by checking the thresholds report.

I think that most online course businesses will eventually need a tax calculation service like Quaderno, due to the low threshold for VAT registration in the European Union.

The good news is that you don't have to register in every single European country separately. Instead, you can register at only one centralized online desk known as VATMOSS, which stands for VAT Mini One Stop Shop.

As I live in the EU myself, I can share with you my first-hand experience with handling VATMOSS taxes. And it's a lot easier than you think.

Some companies will even charge you 2 or 3% of your sales just for relieving you of the responsibility of calculating these taxes. Don't fall for that trap, it's not worth it to give away a significant cut of your business for someone to do your taxes.

Taxes are a lot simpler than you think, and you only need to set up this process once, and that's it you're all set.

How was my experience with the VATMOSS desk?

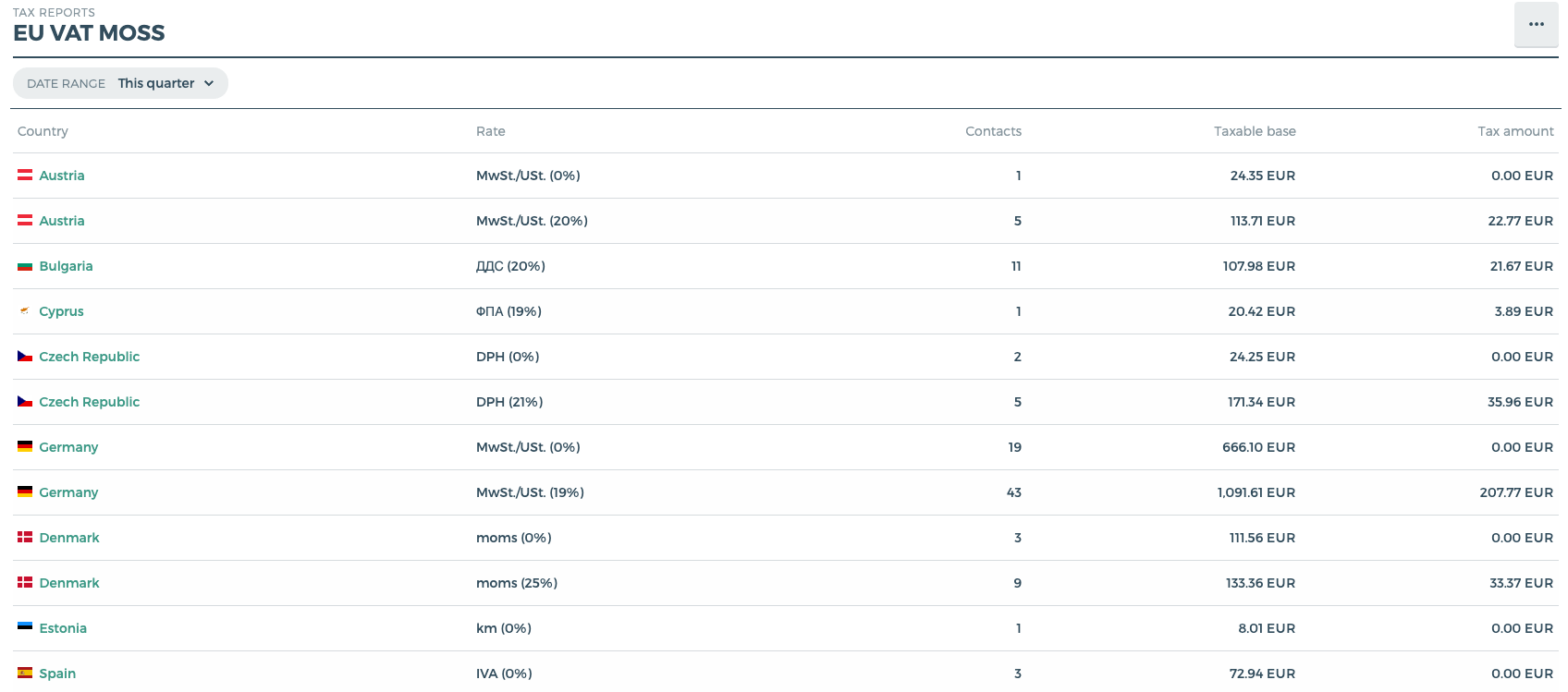

Using the VATMOSS desk, I can easily pay my whole EU VAT taxes with a single quarterly payment, which is super convenient. Again, I recommend checking with your accountant for the exact details.

If you are a business outside the EU, I think you can easily register for VAT in the Irish VAT portal, which is in English. I didn't have to do this myself, so I recommend that you check the Quaderno guide on how to do this.

You can then know how much to pay using the Quaderno VATMOSS report:

At the bottom of this report, I will see the total quarterly amount to pay to the VATMOSS portal. I just have to extract the report as excel, send it to my accountant and he will declare my taxes, it's that simple.

But besides taxes, there is another good reason for using Quaderno, which is to generate invoices for your customers.

How do I create an invoice?

As we have learned, Stripe by itself is great for generating receipts, which are simple payment proof. Many times, this is exactly what our customers want.

But sometimes, a customer needs an invoice with a bit more detailed information other than their email. They also want to add a company name, address, and tax identifier so that they can deduct the invoice as an expense.

Also, they need the VAT of the transaction clearly marked. Since Stripe does not handle taxes currently, I can instead use Quaderno to generate my invoices.

Notice that not all payments in my online business need to have a corresponding invoice. If you think about it, many payments that you make in your daily life like shopping for groceries or buying books don't need an invoice.

You will only ask for an invoice occasionally as a consumer if you need to present it as an expense to an employer for example.

This is true for sales between businesses and consumers, also known as B2C sales. But for sales from business to business, also known as B2B, an invoice is usually required.

Again, these rules might be different in your country, so you really need to check with your accountant.

In either case, at least some of your consumer customers will ask for an invoice due to one reason or another, and certainly most of your business customers. You can easily send them invoices generated in Quaderno or have a remote personal assistant do that for you using the Quaderno team functionality.

How do I create invoices manually?

Not only can I create invoices in Quaderno for payments already made, but I can also create new invoices, asking for new payments.

If you are using the OnlineCourseHost.com platform to host your courses, any payments that you make are going to automatically show up in both Stripe and Quaderno with the correct VAT calculated.

But if I need to create some of the invoices for your business manually, then I can still do that. I can then send the invoice by email to my customers, and they can pay it either online via credit card or even settle it via bank transfer.

As you can see, with Stripe I have a complete solution for managing online payments, and with Quaderno K can easily calculate taxes and generate invoices in case the base Stripe functionality is not enough.

Besides Quaderno, there is other tax calculation and invoicing software available. You can check the Stripe Partners page for what other options there are available.

Once you have your payment solution and (if necessary) your tax calculation solution, you have everything that you need to correctly pay your company taxes, so let's now walk you through the whole process.

How do I manage the accounting of my online course business

In most countries, a company is going to have to fill in quarterly revenue reports. So here is how this works in my case.

During the quarter, I keep sending my expenses to my accountant in a way that works for both of us, in our case we simply use Google Drive.

My accountant will book the expenses throughout the quarter. Next, my customers keep paying me via Stripe, and most of the charges won't result in an invoice because they are made by consumers and not companies.

However, a small number of consumers and my business customers will write me to my support mailbox asking for an invoice instead of a simple receipt.

I can then use Quaderno to convert the receipt into an invoice, with all the necessary details, and I can send an invoice link to the user.

I can even create charges myself using Quaderno for any extra services that I might provide, like for example in-person classes.

Once the quarter ends, I need to extract and send all my invoices to my accountant for booking.

Besides the invoices, I also have to group my consumer sales that did not result in any invoice and declare the total of those consumer sales to my accountant.

I also need to provide bank statements for all my company bank accounts and my company credit card statements. From there, my accountant is going to book everything and get back to me letting me know how much VAT I need to pay, or am due to receive.

At the end of the year, my accountant will submit a tax form for the whole fiscal year, detailing my company revenues, expenses, and VAT paid. Based on that, the state is going to calculate how much yearly company tax do I have to pay on my profits.

Remember, my profits are determined by the sum of all your revenues minus the sum of all my expenses, and you pay taxes on that difference, and not on the total amount invoiced.

If besides doing direct customer sales on your website, you chose to in parallel also publish your courses on marketplace platforms, be careful because those two revenue streams are not taxed in the same way.

The taxes on sales of my courses on a marketplace have already been taxed at the level of the marketplace company. So the money that I receive from the marketplace is considered as royalties (like if I authored a book), and is usually VAT exempt.

As I receive royalties from marketplaces, I make sure to explain that properly to my accountant, to avoid paying unnecessary taxes on those.

Also, remember that my all company expenses reduce the total amount of company taxes that I will pay in the end.

So if I need a nice computer for my business, a phone, or any other piece of equipment, I make sure to purchase it as it's all tax-deductible.

Summary

Let's quickly summarize everything that we have learned about how I would create a company to support my online course business if I was just starting from scratch.

First, I can easily set up a free Stripe account as early as possible and integrate it with a free OnlineCourseHost.com account.

From there, I can start creating online courses and preparing to get my very first sales. Once my first sales arrive, I want to contact an accountant and set up an LLC-style company. Note that this might take several weeks.

From there, as I continue making sales, I would need to book the expenses and revenues quarterly with my accountant. I can monitor the growth of my online course business easily using the Stripe dashboard.

Once I see that my sales in some countries and especially the EU start reaching a certain volume, I will want to set up a digital tax calculation software like Quaderno, to keep things under control.

Quaderno will have the advantage of doubling down as both a tax calculator and invoicing software, but there are other options available.

If my customers ask you for invoices, I can easily send them using Quaderno or equivalent software, as long as it integrates with Stripe (which shouldn't be a problem).

So I hope this helped you understand how I created my online course business and gives you some general idea of how you can create yours as well.

In all steps of the process, it's important to understand that this guide is just general guidance. You need to confirm what you need to do in your particular case with your accountant every time.

I know that it all sounds a bit boring and complicated, but the good news is that it's a very simple process that only needs to be done once, and then every quarter. I, for example, only spend a couple of hours max to make the quarter closure.

Most of the work like sending invoices to customers and expenses to my accountant was easily outsourced at a very affordable price to my remote freelancer assistant, which is another huge advantage of being an internet-based business (more on this in my next guide).

We hope that this guide will give you a general idea of how to start an online course business with minimum hassle!

If you want to learn more about creating online courses, sales, and marketing in general, check out what else is available on the Academy Home Page.

To get notified when new content is available at the Academy, you can subscribe here to my weekly newsletter:

Next recommended guide

The next guide that I recommend that you read is: How to hire an online course team (video editor, assistant, designer)

Any further questions?

If you have any other questions about online course creation in general or on how to create an online course business in particular, please post them in the comment section below, or in our Course Creator Academy Facebook Group.

Either way, our team of course creation experts is happy to help you out.

Vasco Cavalheiro

OnlineCourseHost.com Founder & Online Course Creator

LinkedIn Facebook Page Facebook Group Twitter

You are welcome to ask me any questions in the comments below: 👇👇👇👇

Start Here

Start Here Course Creation Journey Step by Step

Course Creation Journey Step by Step  Course Creation Software Reviews

Course Creation Software Reviews Online Course Marketing

Online Course Marketing Course Creation Tips & Tricks

Course Creation Tips & Tricks Course Equipment

Course Equipment Online Course Marketplaces

Online Course Marketplaces Revenue Reports

Revenue Reports Best Practices

Best Practices Frequently Asked Questions

Frequently Asked Questions Platform Reviews

Platform Reviews