How to Automate Online Course Sales Taxes with Stripe Tax

Platform Review

Platform Review

Learn how to automate tax compliance for your online courses with Stripe Tax. Follow our step-by-step guide to setup, understand tax behaviors, and simplify global tax collection

Handling taxes when selling online courses can be a nightmare. Every country has different tax rules, rates, and requirements, making compliance confusing and time-consuming.

As a course creator myself, I know that your priority is teaching, not navigating complex tax regulations.

But you know just as well as I do, that you absolutely have to get your tax setup right from the start, there is no plan B on this one.

That’s why integrating Stripe Tax into your course platform is a game-changer!

It automates tax calculation, collection, and reporting, making tax compliance effortless.

Disclaimer: While Stripe Tax simplifies a lot all the tax process, it’s important to note that the information provided in this blog post is for informational purposes only and does not constitute professional tax advice. We are not tax experts.

This guide is intended to help you understand and enable Stripe Tax on your course platform. Tax laws and regulations can vary widely, so I recommend consulting your accountant to ensure full compliance with your local tax requirements.

You can also check out all the free guides available at the Course Creator Academy by clicking on the Academy link on the top menu.

Key Benefits of Stripe Tax

Stripe Tax simplifies tax collection for digital products, including online courses. It dynamically calculates, collects, and reports taxes based on the location of your students.

Here are the key benefits:

- Automatic Tax Calculation: Charges the correct tax based on the student's location.

- Compliance Guidance: Helps you understand where to register for tax payments.

- Simplified Tax Reporting: Generates reports that can be handed over to your accountant.

How Stripe Tax Works

Stripe Tax makes tax collection easy by automatically adding the correct taxes to the checkout page based on your student's location.

So, when a student buys a course, Stripe Tax calculates the right tax rate in real time, ensuring compliance with local rules. This removes the need for you to figure out tax rates or worry about mistakes manually.

Also, students see a clear tax breakdown during checkout, making the process smooth and transparent.

One important thing to note is that before Stripe Tax can start working for your course, you’ll need to activate Stripe to receive course payment from your students.

You also need to register in the required tax jurisdictions through your Stripe dashboard. This step is important because taxes will only be applied after registration.

Once registered, it ensures all transactions follow local tax laws, reducing the risk of errors or penalties.

It automates tax calculations, collection, and reporting, saving you time and effort. This lets you focus on creating and selling courses while Stripe takes care of global tax compliance.

Also, Stripe Tax offers two main tax behavior options for your course pricing. You can choose the one that best suits your business model:

Inclusive Pricing

This is when taxes are included in the course price.

Example: If your course costs $150 and the tax is 20%, you receive $130, and the remaining $20 goes to tax payments.

Exclusive Pricing

This is when taxes are added on top of the course price.

For example, if your course price is $150 and the tax is 20%, the total price at checkout becomes $170. You receive $150, and $20 goes to tax payments.

Additionally, you can enable Tax ID Collection for business customers. This feature allows businesses to add their tax ID and legal entity name during checkout, making it easier to issue invoices.

Next, I’ll show you how to activate Stripe Tax for your course.

Step-by-Step: How to Enable Stripe Tax

As mentioned earlier, before enabling Stripe Tax, make sure you adhere to the following:

- Activate and connect Stripe to receive course payment from your students.

- Register in the tax jurisdictions where you need to collect and pay taxes.

- Tax compliance depends on local regulations, so ensure you're registered appropriately.

Enable Stripe Tax on Your Course Dashboard

Once you have registered in the tax jurisdiction where you want to sell your course and collect taxes, follow the steps below:

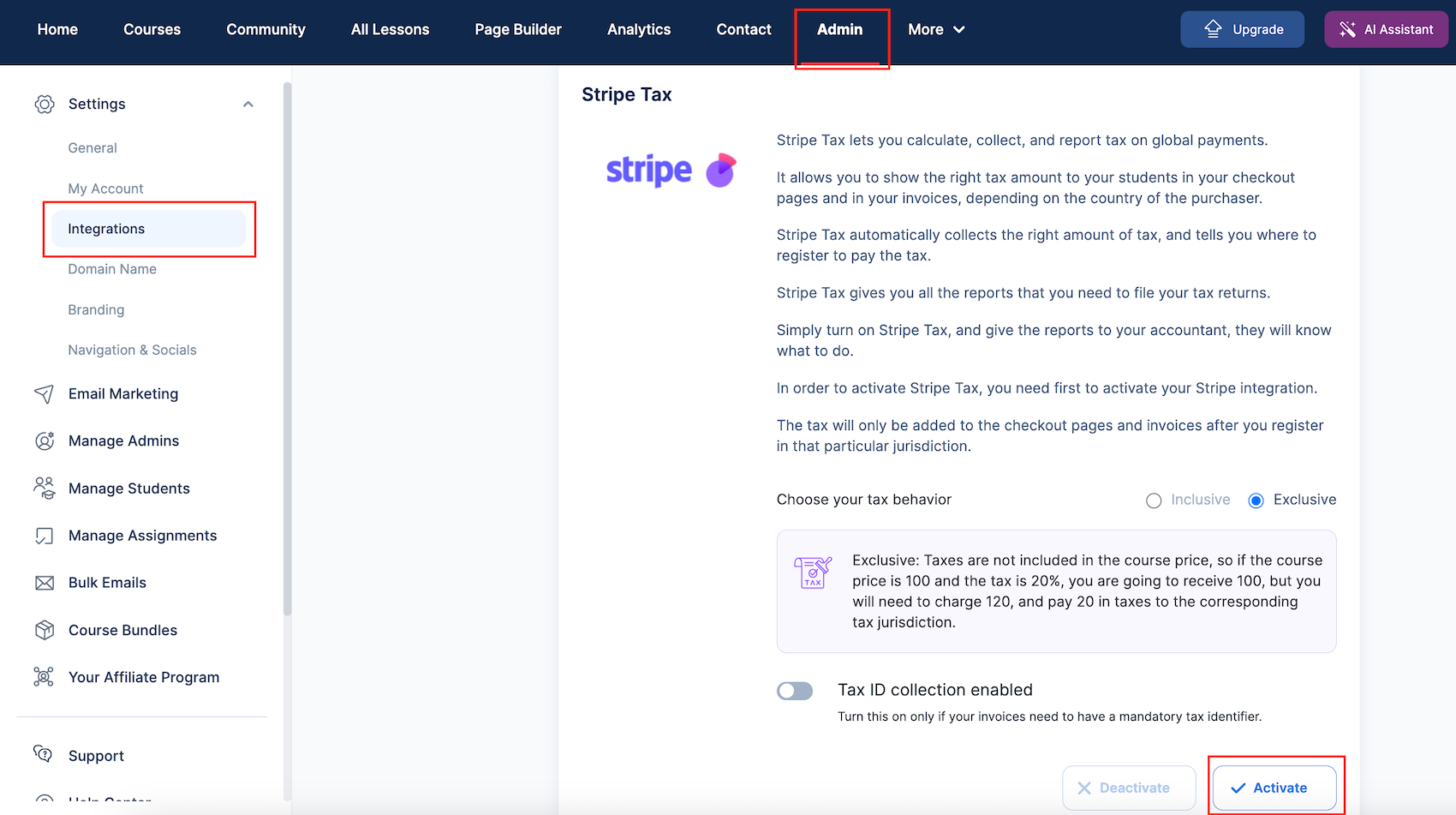

- Log in to your platform

- Navigate to Admin, then click on Integrations

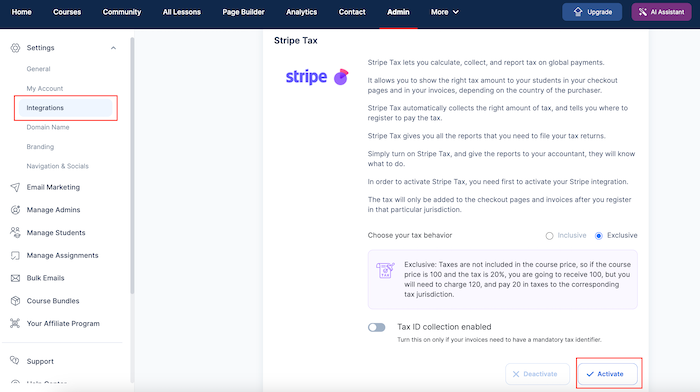

- Scroll down and click on "Activate."

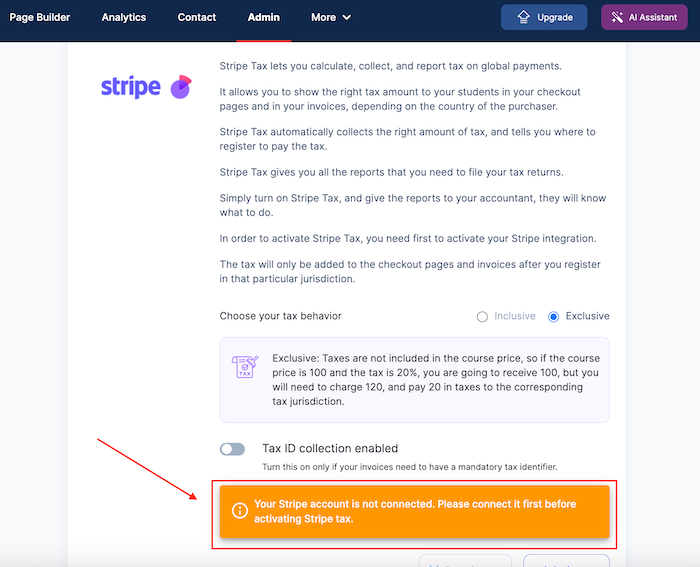

Note that this step requires you to activate and connect your Stripe account first; if not done, you'll get this error below:

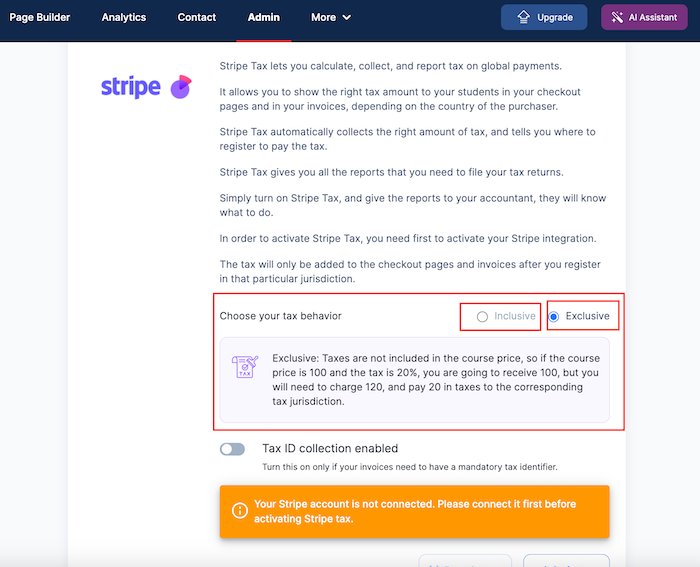

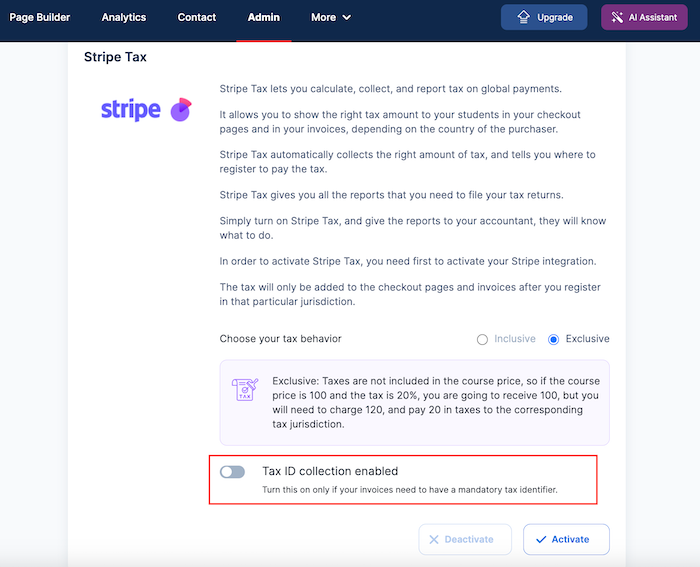

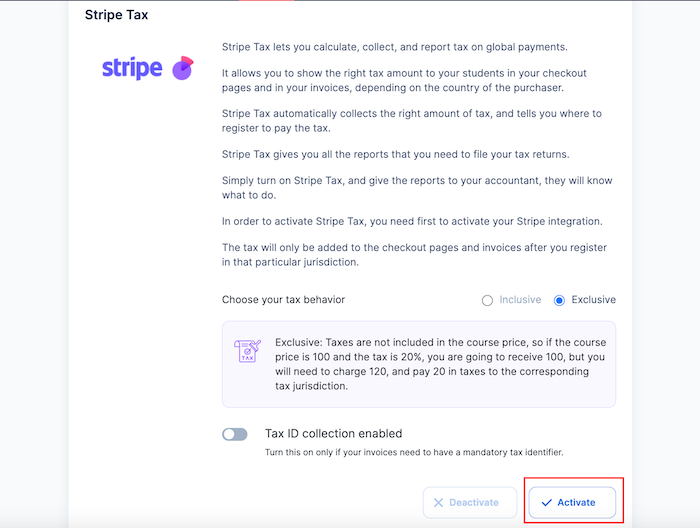

- Select your tax behavior. There are two behaviors, which I already explained:

- Inclusive – This is when taxes are included in the course price.

- Exclusive – This is when taxes are added on top of the course price.

Enable Tax ID Collection if you sell to businesses and want them to add a tax ID to their invoices. This is optional.

Click Activate.

Final Thoughts

With Stripe Tax, you can automate tax collection and reporting, reducing the headache of tax compliance. This allows you to focus on what truly matters—teaching and growing your online course business.

While this guide walks you through enabling Stripe Tax for your courses, it is for informational purposes only and does not constitute tax advice. It’s important to consult a tax professional to ensure full compliance with your specific tax obligations.

And remember these:

- Activate and Connect your Stripe Account First: You must first register for a Stripe account for the collection of course payment. Without this, Stripe Tax will not function, and taxes will not be applied to your course sales.

- Tax ID Collection: If enabled, students purchasing as a business can enter their tax ID and legal entity name at checkout, making it easier for them to claim tax deductions.

- You Are Responsible for Tax Compliance: While Stripe Tax simplifies the process of tax collection and reporting, it does not handle tax registration or filing on your behalf. You are still responsible for ensuring compliance with the tax regulations in the jurisdictions where you operate.

Ready to simplify tax collection? Enable Stripe Tax on your course platform today!

I hope you enjoyed this post. To get notified when new content is available here at the Academy, you can subscribe here to our weekly newsletter:

Join the Course Creator Academy Facebook Group

Ready to learn how to launch your first coaching program or course on OnlineCourseHost.com? Here are the helpful guides for you to check out:

- Best Online Course Platforms (Ultimate Guide)

- How To Choose An Online Course Topic That Sells

- How To Record And Edit Your First Online Course

- Affordable Online Course Equipment - Complete Practical Guide

- How To Hire An Online Course Team

- The Ultimate Online Course Launch Checklist

- How To Create The Perfect Online Course Sales Page

- Create A Powerful Brand For Your Online Courses (In 5 Steps)

- How To Sell Online Courses? The Ultimate Guide

- How To Promote Your Online Course - Complete Guide

Let me know in the comments below what other topics you would like me to cover or any questions that you have.

Thanks for reading… and enjoy the course creation process! 😉

Course Creators Academy, a community by OnlineCourseHost.com

Founded by Vasco Cavalheiro

Online Course Creator

Start Here

Start Here Course Creation Journey Step by Step

Course Creation Journey Step by Step  Course Creation Software Reviews

Course Creation Software Reviews Online Course Marketing

Online Course Marketing Course Creation Tips & Tricks

Course Creation Tips & Tricks Course Equipment

Course Equipment Online Course Marketplaces

Online Course Marketplaces Revenue Reports

Revenue Reports Best Practices

Best Practices Frequently Asked Questions

Frequently Asked Questions Platform Reviews

Platform Reviews